Lump sum pension payout calculator

So someone whod built up an annual state pension of. Find out what the required annual rate of return required would be for.

Social Security And Lump Sum Pensions What Public Servants Should Know Social Security Intelligence

Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life.

. Should you consider a lump sum pension withdrawal for your 500K portfolio. A simplified illustration. Why Take a Lump Sum Pension Payout.

Generally the option with a higher present value is the better deal. For every 1 of pension you give up you will get 12 of tax free lump sum. When you take your pension you will be able to give up some of it for lump sum up to a certain limit.

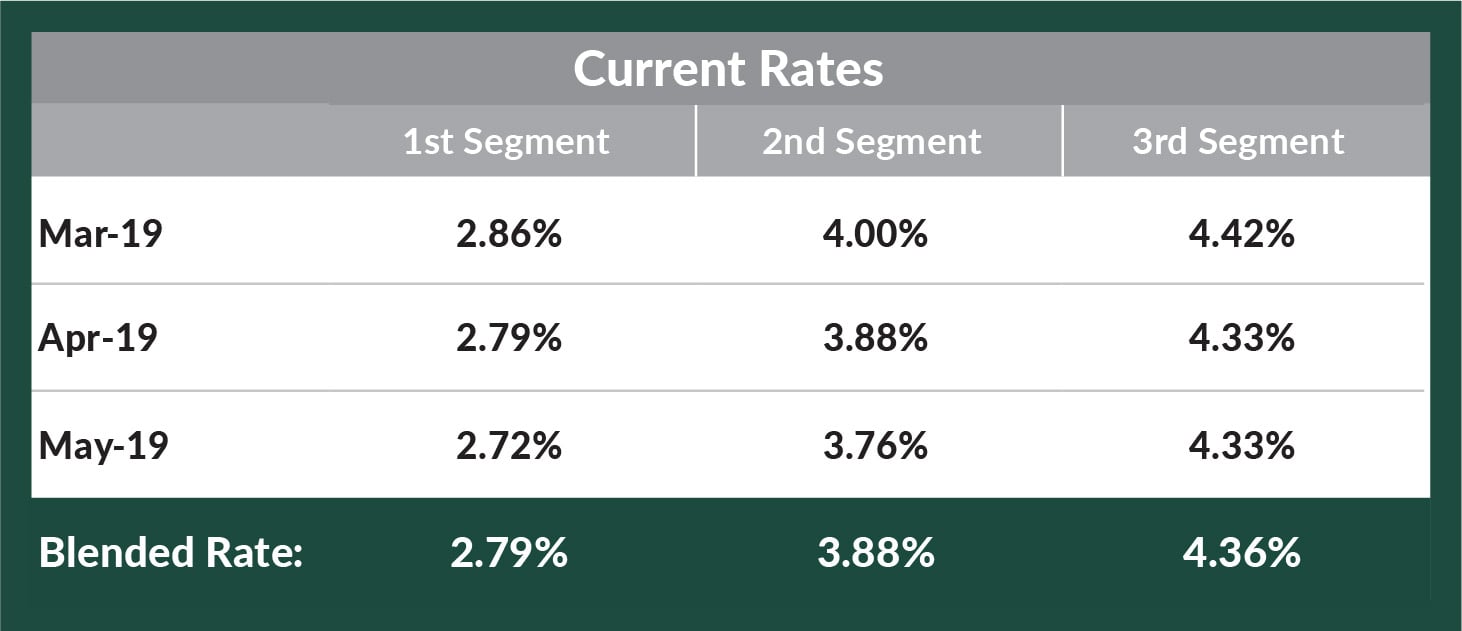

And The Right Choice May Not Be Obvious. Find a Branch Contact a Financial Advisor Finras Brokercheck CALL 1-877-579-5353. The savings interest rate that you designate is used to calculate present value for the annuity payment option and is.

Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life. Find out what the required annual rate of return required would be for. But keep in mind that a lump sum pension payout makes it easier to overspend in retirement.

Try the free Pension vs. Ad Get Personalized Action Items of What Your Financial Future Might Look Like. Annuity payment calculator compares two payment options.

We have the SARS tax rates tables. Ad Learn how a lump sum pension withdrawal may give you more income flexibility. How to Avoid Taxes on a Lump Sum Pension Payout.

You have access to the cash you. Find out what the required annual rate of return required would be for. This is known as a lump-sum payout option.

New Look At Your Financial Strategy. Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life. Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life.

Work out what lump sum you need when you retire to produce a certain level of income. Lets say you decided to retire at 65 and you worked out you needed 80000. Ad Estimate The Impact Of Taking An Early Withdrawal From Your Retirement Account.

If you choose a lump-sum payout instead of monthly payments the responsibility for. Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life. Ad Build Your Future With a Firm that has 85 Years of Investment Experience.

Receiving a lump sum. Use our fund benefit calculator to work out the tax payable on lump sum payments from Pension funds Provident funds andor Retirement Annuity funds. Investors can avoid taxes on a lump sum pension payout by rolling over the proceeds into an individual retirement account.

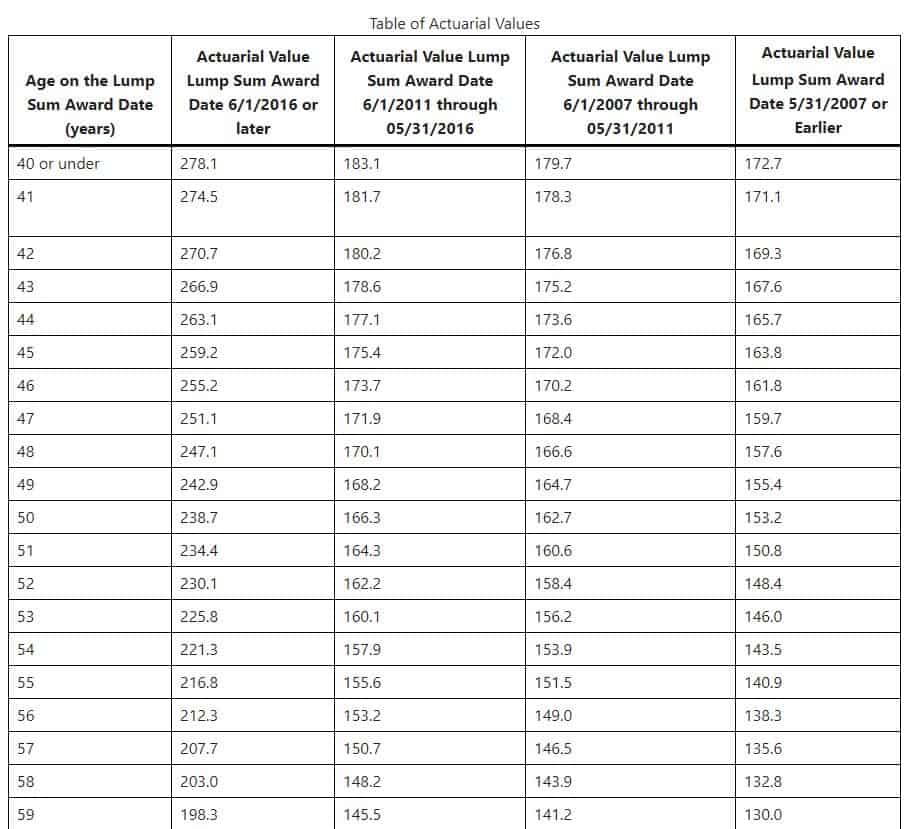

Retirees Often Face a Tough Decision. If the rate used is 4 a pension benefit of 5000 monthly 60000 a year over 20 years would yield a lump sum of about 815419 Titus calculated. Start Planning Your Financial Future With Our Digital Retirement Coach.

To find out how this works in detail you can read our guide Should I take a lump sum from my pension. This calculator will help you figure out how much income tax youll pay on a lump. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

Learn More About Potential Lost Asset Growth Tax Consequences Penalties At TIAA. Our lump sum vs. Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life.

Ad The Pension-vs-Lump-Sum Decision Leaves Retirees With a Conundrum. Both are represented by tabs on the calculator. Visit The Official Edward Jones Site.

Find out what the required annual rate of return required would be for. A one-time payment for all or a portion of their pension. Ad Learn how a lump sum pension withdrawal may give you more income flexibility.

That new car or luxurious vacation may not seem like such a splurge when youre. Find out what the required annual rate of return required would be for. Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

Employees often consider taking a lump sum pension payout for three common reasons. Lump-Sum The lump-sum payment option allows annuitants to withdraw the entire account value of an annuity in a single withdrawal. Should you consider a lump sum pension withdrawal for your 500K portfolio.

Sbi Annuity Deposit Scheme Calculator For Monthly Pension Payout Youtube

How Much Will I Get

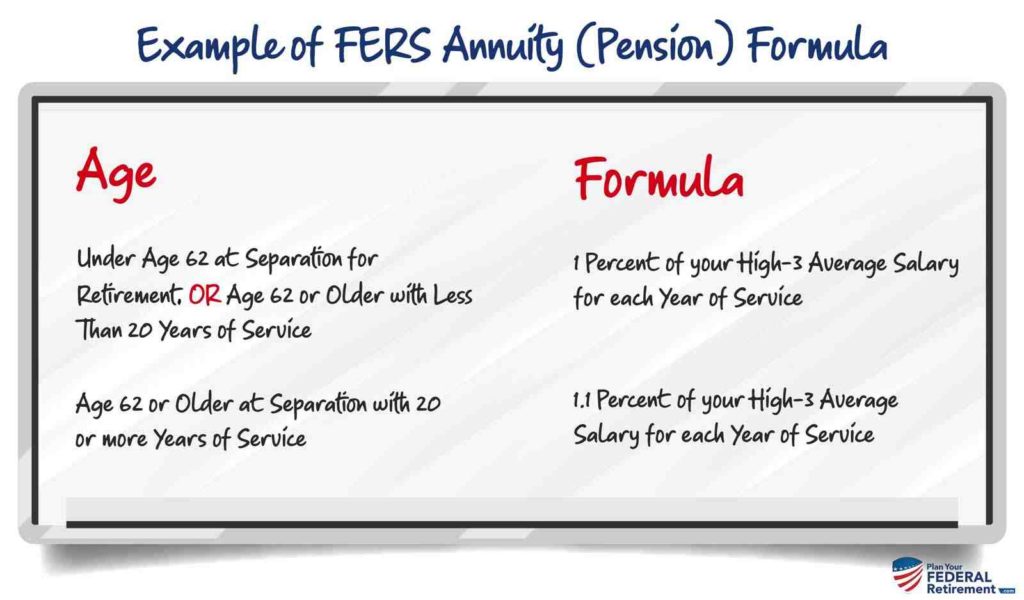

Federal Pension Calculator Government Deal Funding

How Do I Calculate My Federal Pension Government Deal Funding

Estimate Your Benefits Arizona State Retirement System

How To Pick Your Retirement Date To Optimize Your Chevron Pension

Pension Vs Lump Sum Payout Calculator Cornerstone Financial Management

Estimate Your Benefits Arizona State Retirement System

Military Retirement Pay Calculator Military Onesource

Tips For Making A Lump Sum Pension Payout Offer Cfo

Should I Take My Pension As A Lump Sum Things To Consider Blue Chip Wealth Advisors Beau S Corner

Federal Pension Calculator Government Deal Funding

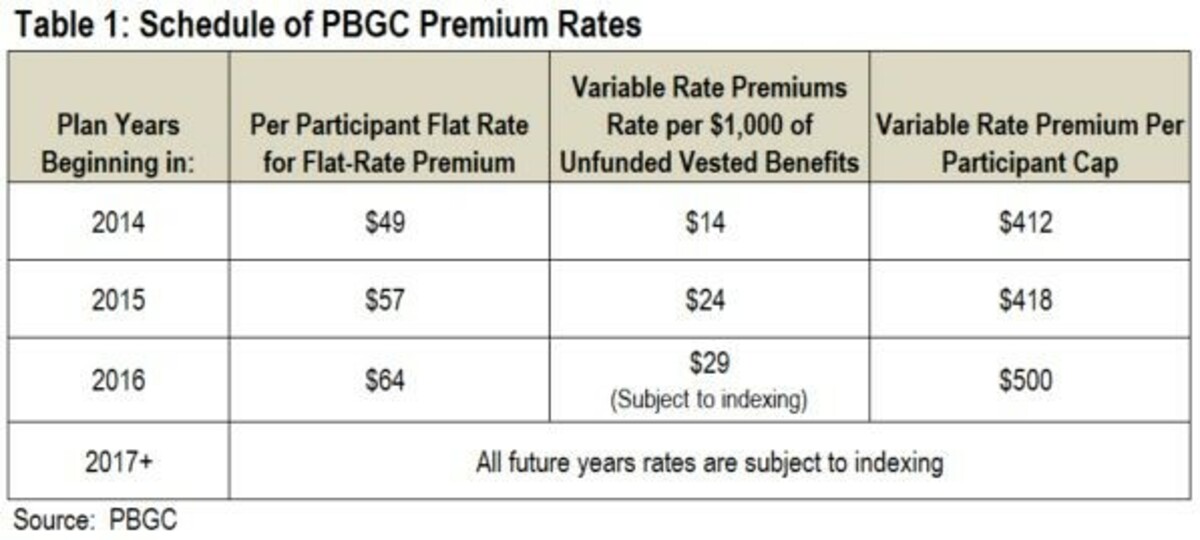

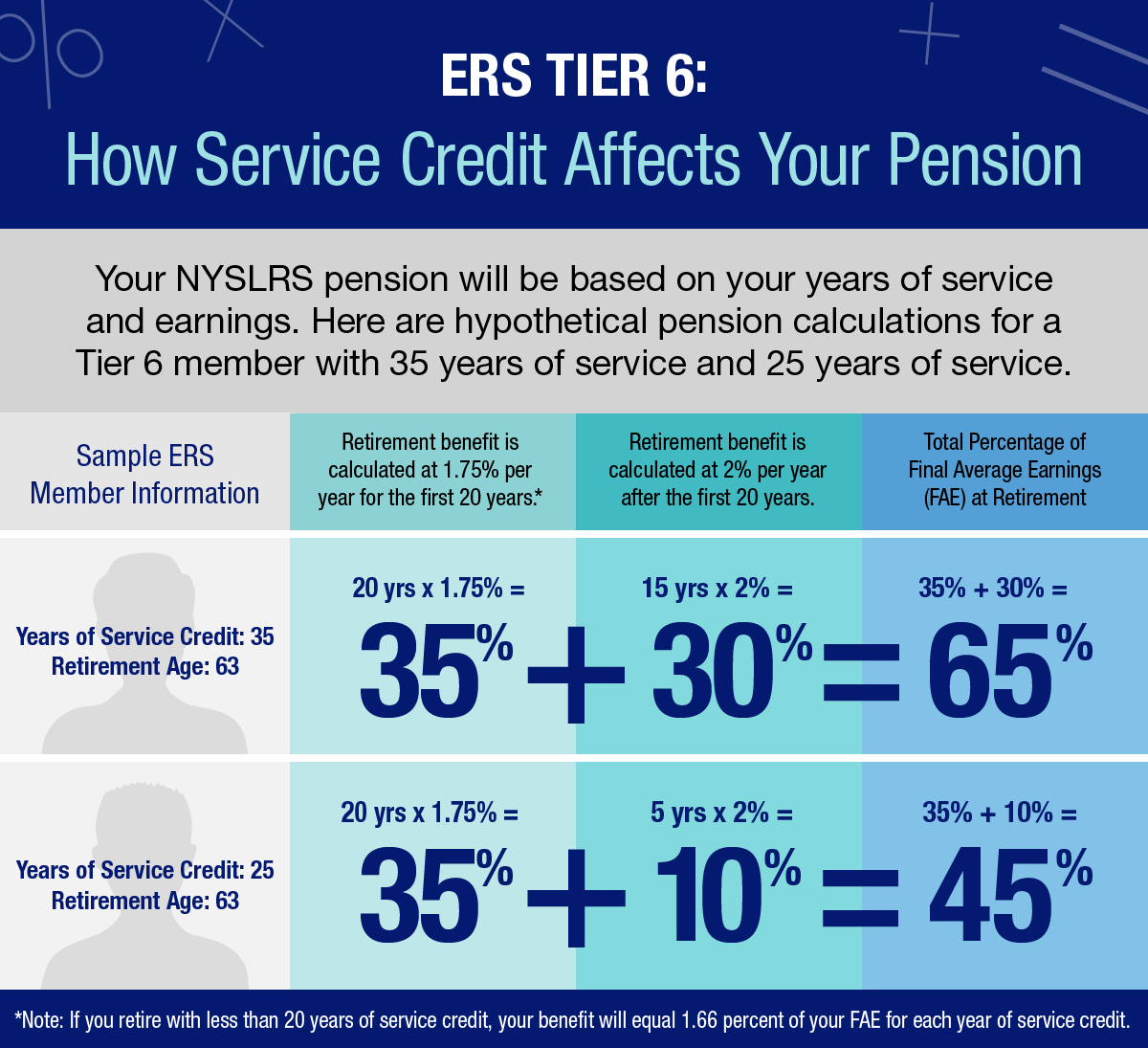

Ers Tier 6 Benefits A Closer Look New York Retirement News

Using The At T Pension Calculator

Retirement Withdrawal Calculator For Excel

Retirement Pension Lump Sum Or Monthly Annuity Payment Your Money Your Wealth Podcast 354 Youtube

3 Ways To Calculate Retirement Benefits In Kenya Wikihow